-

2025 Estate & Gift Tax Update

2025 continues to offer the historically large federal unified exemption amount for bequests and lifetime gift-giving in effect since 2018, and because of this significant change from prior years, careful review of tax planning provisions in existing estate planning documents may be warranted ‒ as well as consideration of lifetime gift planning.) -

2023 Estate & Gift Tax Update

2023 continues the recent trend of an historically large federal unified exemption amount for bequests and lifetime gift-giving, and because of this significant change from earlier years, careful review of tax planning provisions in existing estate planning documents is warranted ‒ as well as consideration of lifetime gift planning. -

2021 Estate & Gift Tax Update

2021 continues the recent trend of an historically large federal unified exemption amount for bequests and lifetime gift-giving, and because of this significant change from earlier years, careful review of tax planning provisions in existing estate planning documents is warranted ‒ as well as consideration of lifetime gift planning. -

2020 Estate & Gift Tax Update

2020 continues the recent trend of an historically large federal unified exemption amount for bequests and lifetime gift-giving, and because of this significant change from earlier years, careful review of tax planning provisions in existing estate planning documents is warranted ‒ as well as consideration of lifetime gift planning. -

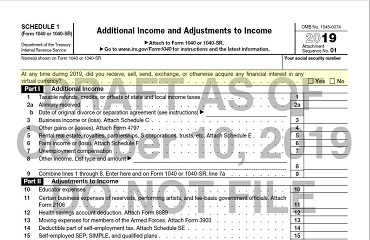

IRS Steps Up Focus on Cryptocurrency

The Agency's recent flurry of letters to cryptocurrency owners, coupled with additional if overdue guidance, sheds light on its thinking. -

Offshore Accounts? Hiding Assets? Who, Me? The FinCEN, the FBAR, and the FATCA.

Many U.S. citizens or residents own bank and other financial accounts located outside the United States for perfectly legitimate reasons, but some may be unintentionally running afoul of "money laundering" laws -- and risking stiff penalties -- by not annually reporting those accounts when the value exceeds $10,000. -

2019 Estate & Gift Tax Update

2019 continues the recent trend of an historically large federal unified exemption amount for bequests and lifetime gift-giving, and because of this significant change from earlier years, careful review of tax planning provisions in existing estate planning documents is warranted ‒ as well as consideration of lifetime gift planning. -

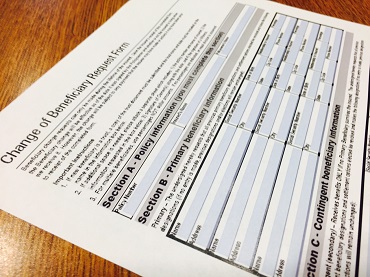

Who Gets My 401(k)?

The determination of who gets your 401(k) at your death depends on a combination of factors -- whom you intend as a beneficiary of your Plan is not always the same person as who is your Beneficiary. -

2018 Estate & Gift Tax Update

2018 brings a large increase to the federal unified exemption amount for bequests and lifetime gift-giving, and this significant change warrants careful review of tax planning provisions in existing estate planning documents ‒ as well as consideration of lifetime gift planning. -

Should We Get Married?

The ultimate question of whether to marry is far beyond the scope of a law-related article, but there are a number of legal implications pertaining to one's financial matters that arise upon the declaration of "I do," some of which are the subject of this month's A Legal Moment. -

Who Gets What? The Right of Survivorship Feature in Jointly Owned Assets

Although an effective tool generally to avoid probate, a Right of Survivorship Feature in jointly owned assets can have unintended consequences. -

2017 Estate & Gift Tax Update

While 2017 brings only incremental increases in the Federal exclusion amounts for bequests and lifetime gift-giving, the significant changes in, and uncertainty about, exclusion amounts over the past 5-10 years warrant careful review of tax planning provisions in older estate planning documents. -

Asset Titling: How is Your Car Titled?

The manner in which assets are titled can have significant repercussions in terms of transfer at the owner’s death -- and potentially in other areas. With that in mind, you may wish to take a moment to check the title to your car; what you find may surprise you. -

2016 Estate & Gift Tax Update

Recent increases in the Federal exclusion amounts for bequests and lifetime gift-giving warrant reviewing existing estate planning documents. -

PODs & TODs: Proceed (or Not!) with Caution

Setting up "Payable on Death" and "Transfer on Death" accounts warrants extreme caution, and in many cases, it may be better to forego such designations altogether. -

IRA & Life Insurance Beneficiary Designations: Time for a Tune-up?

A substantial portion of a person’s assets may be governed by beneficiary designations rather than by the terms of that person's Will. It is important to pay careful attention to beneficiary designations to make sure, in the event of your death, that your property is distributed according to your wishes.

Comprehensive Legal Services for Businesses and Individuals.

Enjoy the advantages of combining the diverse practice of a large firm with the personal relationship only a small firm can offer. Contact Us